avalara tax code matrix

Upload a list of your products so Avalara can make tax code recommendations. If you must map more than 100000 SKU codes to.

Set Up Avatax Connector For Salesforce Sales Cloud For Your Tax Calculation Needs Avalara Help Center

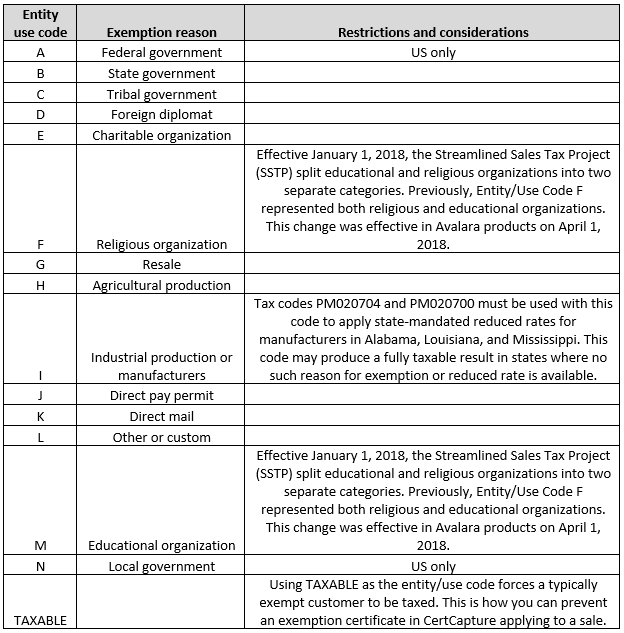

AvaTax System Tax Codes in blue font.

. The tax rate on freight is adjusted proportionally so 25 of the freight charge is taxed at 625 and 75 is taxed at 10. The tax code should be passed with a 0 line amount. If Avalara is unable to validate a mailing address Avalara will use the tax rates applicable to the ZIP code for such.

Avalara will use Store Location mailing addresses to determine tax rates. Avalara Tax Research 2 min. AvaTax System Tax Codes AvaTax System Tax Code AvaTax System Tax Code Description Additional AvaTax System Tax Code Information Note.

You can copy and paste a code you find here into the Tax Codes field in. Content is shown for. Find the Avalara Tax Codes also called a goods and services type for what you sell.

No credit card required. Avalara tax code matrix Thursday. After youve reviewed the tax.

The 027 fee will automatically be calculated when this tax. You can use this search page to find the Avalara codes that determine the taxability of the goods and services you sell. You can use this search page to find the Avalara codes that determine the taxability of the goods and.

Avalara MatrixMaster makes it easy. 2022 Avalara Inc. The total freight charge is 10000 and the total tax.

Ad Industry Leading Sales Tax Solution. 25 of 10000 2500. Simplify your research solution with access to a QA database and dedicated tax.

Avalara Tax Research Standard. This tax code is only to be used to trigger colorados 027 retail delivery fee. With a powerful database of over 15 million codes Avalara MatrixMaster is the worlds largest database of Universal Product Codes UPC with.

TaxCode the Avalara Product Tax code for the variant. Use a self-service research tool to help find the tax answers you need. Avalara Streamlined Sales Tax.

Find the right Avalara tax codes for your products and services. Its important to note that there is a maximum of 100000 items per import. These tax codes are.

We help companies to transact comply and grow with confidence. P0000000 and U0000000 are generic codes that are used when you have items that arent mapped to an Avalara tax code. The most common place to map an item to a tax code is the place where you maintain your master inventory list which is typically in your business application.

Enter the details for your custom tax code including the type the code and a description. All rights reserved Terms and Conditions. Avalara for Small Business.

Select Custom Tax Codes and then select Add a Custom Tax Code. Find the Avalara Tax Codes also called a goods and services type for what you sell. P0000000 and U0000000.

Returns for small business Free automated sales tax filing for small businesses for up to 60 days.

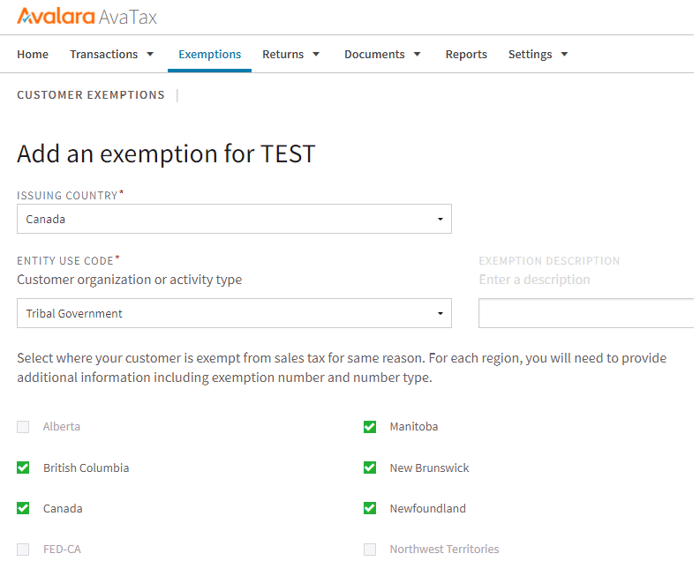

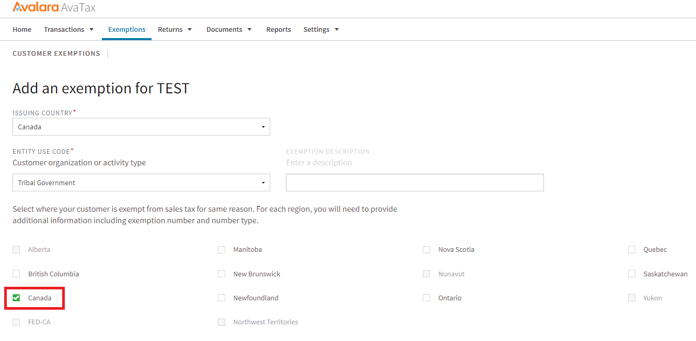

Avalara Avatax Set A Customer To Be Tax Exempt In U S And Canada

Avalara Avatax Set A Customer To Be Tax Exempt In U S And Canada

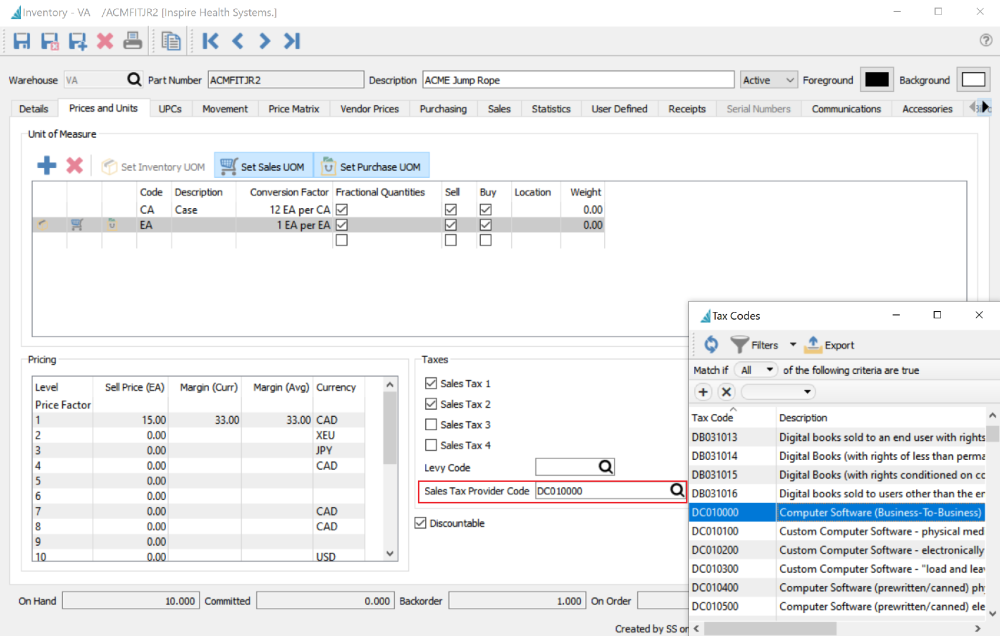

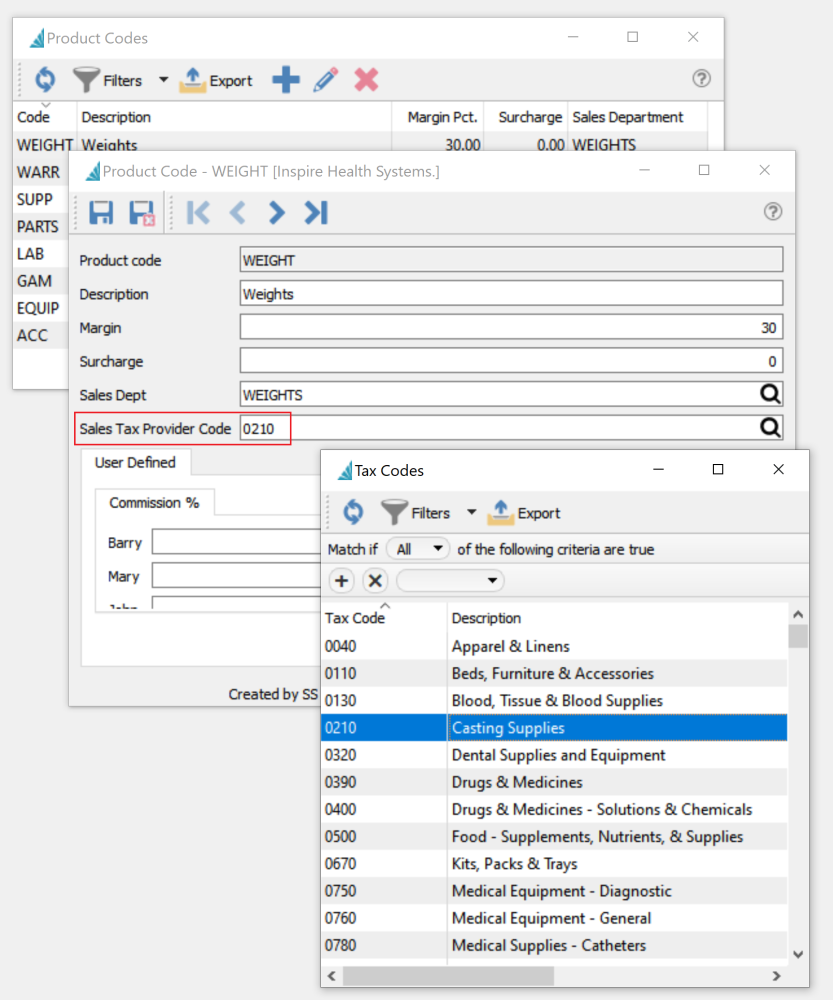

Map The Items You Sell To Avalara Tax Codes Avalara Help Center

Connector For Netsuite Avalara Help Center

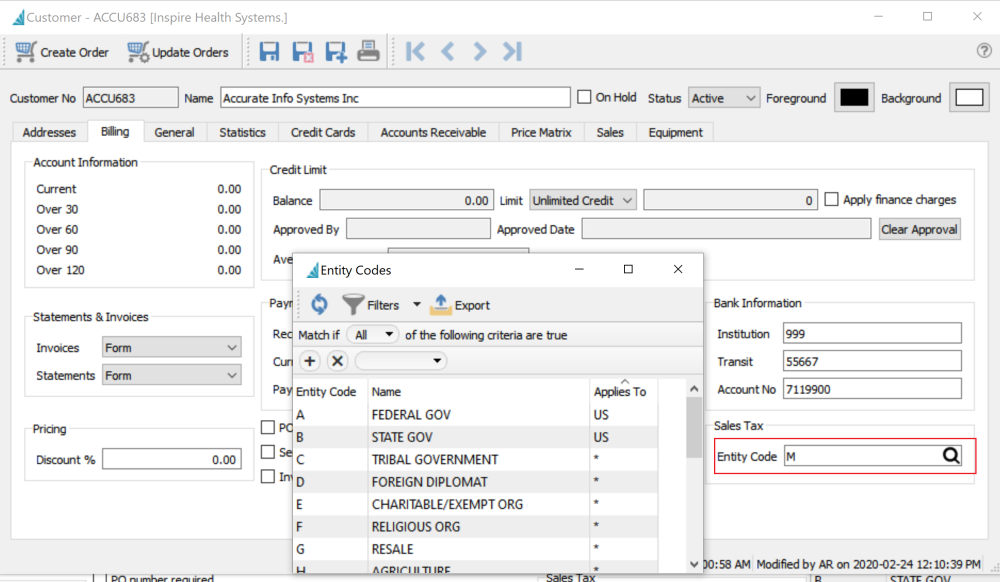

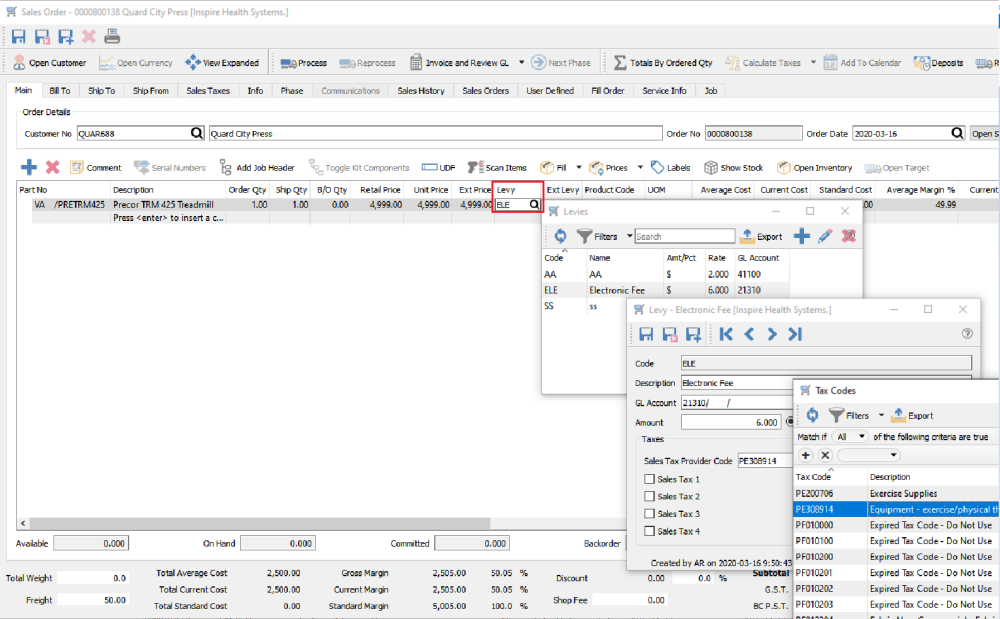

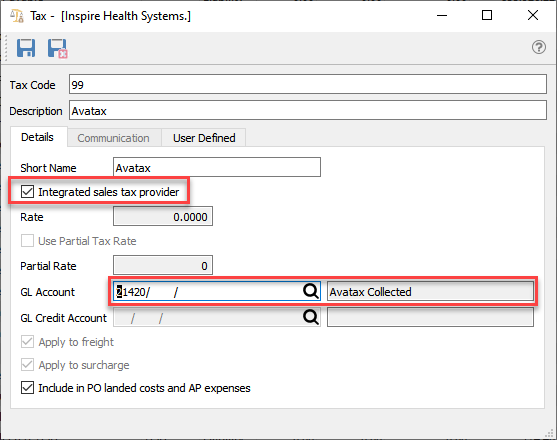

Avalara Sales Tax Spire User Manual 3 5

Avalara Avatax Set A Customer To Be Tax Exempt In U S And Canada

Understanding Freight Taxability Avalara Help Center

Avalara Sales Tax Spire User Manual 3 5

Avalara Sales Tax Spire User Manual 3 5

Avalara Sales Tax Spire User Manual 3 5

Avalara Sales Tax Spire User Manual 3 5

Subscription Software Integration With Avalara Subscriptionflow

Nexus And The Sales Tax Puzzle Avalara Video Encore Business Solutions

Avalara Avatax Set A Customer To Be Tax Exempt In U S And Canada

Set Up Avatax Connector For Salesforce Sales Cloud For Your Tax Calculation Needs Avalara Help Center

Avalara Sales Tax Spire User Manual 3 5

Avalara Acquires World S Largest Database Of Universal Product Codes Geekwire

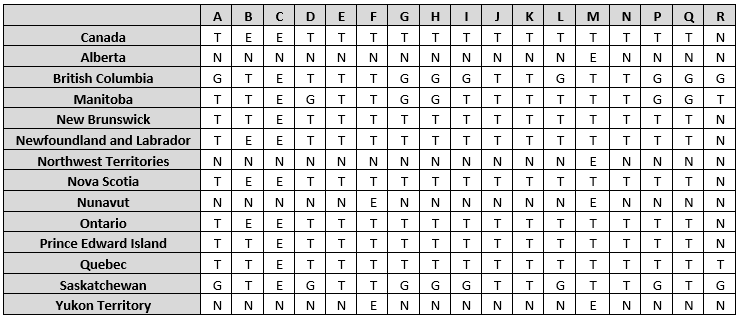

Use The Exemption Matrix To Customize Your Settings Avalara Help Center